On March 17, 2021, our client was driving home to South Carolina after flying into the Atlanta airport returning home from a trip to New Orleans. She was at complete stop in traffic on Interstate 85 in Franklin County, Georgia when she was rear-ended by a tractor trailer (2014 Freightliner) at a very high speed that was being driven by the defendant (a trucking company), the defendant made no effort to brake and slammed violently into the back of our client’s SUV. Our client’s SUV was then pushed into a tractor trailer in front of her, resulting in a secondary collision. Here is what her SUV looked like after the wreck:

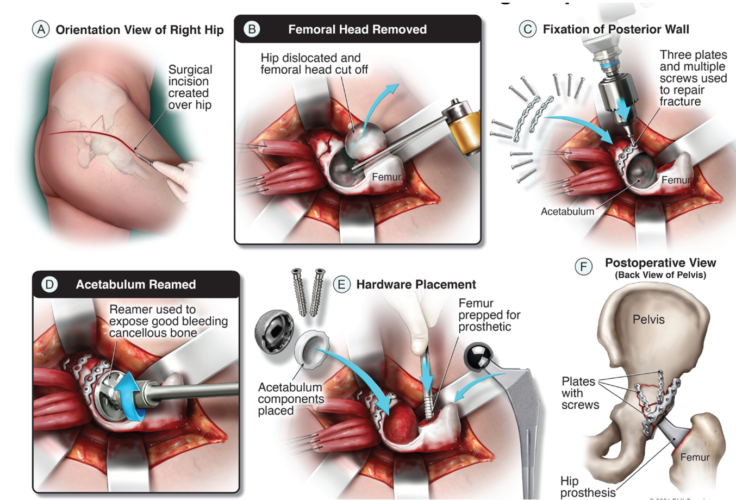

First responders were immediate on the scene and had to make a choice between taking the plaintiff to Grady Hospital in Atlanta or to Greenville Memorial Hospital. Due to traffic concerns traveling back to Atlanta, she was taken by ambulance to Greenville. Upon arrival, she was diagnosed with a displaced and comminuted fracture of the right hip, fractures to multiple ribs on her right side, finger fracture, traumatic pneumothorax, and a liver laceration among, other injuries. Her head was also hurting. Our client immediately underwent an open reduction internal fixation (“ORIF”) surgery and right total hip arthroplasty surgery.

Here is a medical illustration we commissioned to demonstrate her injury and surgery to the insurance company:

Our injured client remained hospitalized for more than a week, including spending time in the ICU. Her injuries also required her to attend in patient acute care immediately after her hospitalization. This lasted for approximately two weeks. Our client then had months of rehabilitation and follow-up doctor’s visits. In total, she incurred nearly $300,000 in medical bills. Our client is a professional and small business owner. Her orthopedic injuries caused a major disruption on her ability to do her job and live her life with her husband and children. Further, our client suffered from headaches and head injury symptoms which impacted her every day since the wreck. Our client is tough and fought through these injuries best she could. Our client never complained and only focused on getting better. Once we were retained by our client, we immediately hired a Collision Specialist Company to inspect the tractor trailer. The inspection revealed 3 of the 6 brakes on the tractor were defective and out of service.

The inspection also revealed another brake was out of adjustment.

This meant the truck driver would be forced to take one of two positions – either:

– he was not paying attention and ran into the rear of our client OR;

– he tried to brake but he was unable to do so in time.

Either position was a bad one.

Finally, the inspection found the tractor had no proof of completing a current annual inspection. We used these facts to hammer home the point to the insurance

company that we were going to make the trucking company look really bad in front of a jury at a potential trial. We also completed a background check on the at-fault truck driver which revealed he had been cited in the past for such moving violations as: causing damage to an unattended vehicle; failing to obey a highway sign/sleep; careless driving and no proof of insurance.

Along with the investigation by the police officer, these were key findings we used to bring “heat” into the case. There was no question as to who was at fault for this wreck and why it happened. And our innocent victim was badly hurt. Once we obtained the above information, we moved quick in presenting a time- limited policy limits demand on the insurance company for the at fault trucking company to force them to make a quick decision on the case. The policy limits

were $750,000 and we made a demand for the full limits amount on May 4, 2021. This demand was accepted in full on May 26, 2021 – less than 75 days after the wreck. Because there were two injured parties, we had to split those limits and we negotiated with the lawyers for the driver of vehicle 3 and agreed to split the policy at $715,000 (Our client) and $35,000 (driver of the track she was pushed into). We then turned our attention to our client’s Underinsured Motorist Coverage. Our client and her husband live in South Carolina where the laws are a little different from Georgia when it comes to taking advantage of having multiple car’s insured. Our client and her husband own 3 cars, and each were insured with $500,000 in UM coverage. In Georgia, we would have been limited to just $500,000 in available coverage for Lisa. In South Carolina, the policies on the 3 cars “stacked” on top of each other for a total coverage amount of $1,500,000. We then made a time limited demand on their insurance company for the full amount of available insurance coverage – $1,500,000. In response, the insurance company offered our client $850,000. While that was not an unreasonable offer, we felt our client’s injuries and the mechanics of the wreck warranted a higher settlement for her. So, we flat out rejected that offer. In response just a few days later, the insurance company invited us to mediation saying they would agree to offer more – so we accepted their invitation. After an all-day mediation on August 9, 2021, the insurance company agreed to offer $1,300,000 of the $1,500,000 in available coverage. Our client agreed to accept this amount and her case fully settled.

Our client’s case highlights two major things:

1. Purchase as much UM coverage to protect yourself as you can reasonably afford. Had our client not done that, her settlement would have been limited to

$715,000. Instead, her case settled for $2,015,000.

2. Our client’s case fully settled less than 6 months after the wreck. While it is true that claims and lawsuits can drag out for years and years, if you are aggressive in pushing the case and provide the insurance company with the information needed to fully evaluate a case, they can be handled in a very efficient manner like was done here.